🏦 Discovering the Magic of Credit Scores

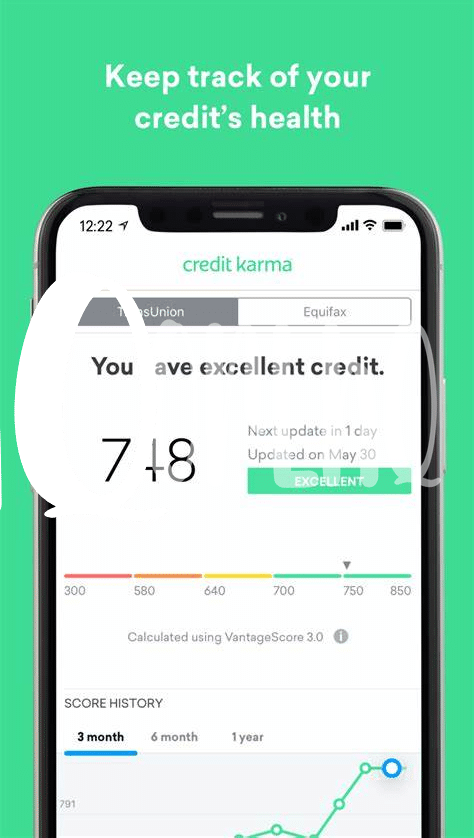

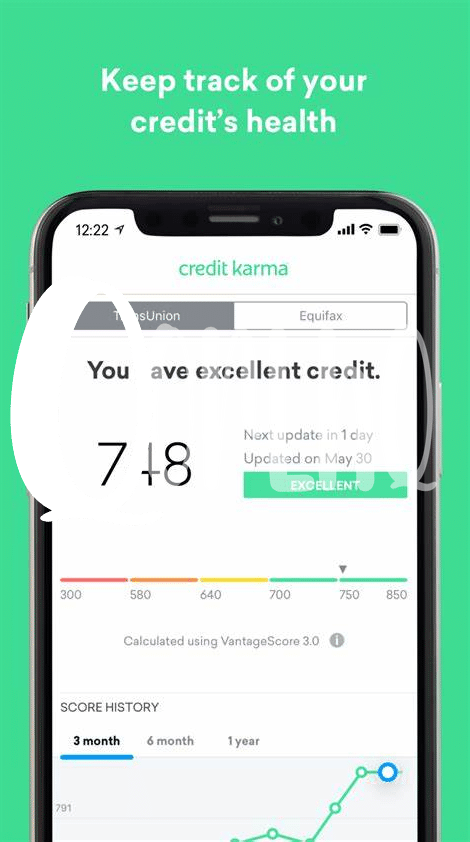

Imagine you’re holding a magic wand that shows how well you play the game of money – that’s essentially what credit scores are like! Think of it as a report card that banks and lenders peek at to decide how trustworthy you are. The higher your score, the easier it is to get loans with sweet terms and low interest rates. The cool part? The Imac Credit Karma app turns understanding and improving this score into a breeze. It’s like having a financial coach in your pocket, guiding you on how to beef up your score step by step. Whether it’s paying bills on time or keeping your credit card balance low, the app lays it all out in simple, actionable advice.

Here’s a quick look at how credit scores can affect your financial health:

| Credit Score Range | What It Means |

|---|---|

| 300-579 | Seen as risky, might face high interest rates or get denied for loans |

| 580-669 | Fair, but can improve for better loan terms |

| 670-739 | Good, eligible for reasonable loan interest rates |

| 740-799 | Very good, receives very favorable loan conditions |

| 800+ | Excellent, qualifies for the best deals and lowest interest rates |

By keeping an eye on your credit score and taking steps to enhance it, you’re setting the stage for a healthier financial future. And with Imac Credit Karma, discovering the ins and outs of this bewildering world becomes not just easy but also quite fun!

🛠️ How Imac Credit Karma Revamps Budgeting

Taking control of your money starts with understanding where it’s going. This is where a handy helper like Credit Karma steps into the picture. Imagine having a bird’s-eye view of your finances, all neat and tidy in one place. Credit Karma does just that, making it easier than ever to set and stick to a budget. You’ll start seeing your spending habits clearly, helping you cut back on the not-so-necessary stuff and save more.

But it’s not just about tracking; it’s about learning and adjusting. Think of it like having a financial coach in your pocket. Credit Karma offers tips and tricks tailored just for you, turning budgeting from a chore into a challenge you’ll want to win. Whether it’s saving for a rainy day or treating yourself, managing your money smartly gets simpler. And while you’re improving your financial health, consider turning your iPad into a security hub with Blink. For more incredible app insights, visit https://iosbestapps.com/exploring-the-top-features-of-vision-pro-showtime-app.

🌱 Growing Your Savings Smartly with Tips

Imagine a world where saving money isn’t just something you try to do after paying the bills, but a skill you master, making every dollar work in your favor. That’s where the magic happens with simple yet effective tips. First off, you’ll learn to set realistic goals, like saving for a holiday or an emergency fund, by breaking them down into small, achievable steps. 🐷💡Then, understanding where your money goes each month (yes, those coffee runs count!) helps you spot areas to cut back. But it’s not all about cutting back. It’s also about finding smarter ways to save, like setting up automatic transfers to your savings account right after payday, so you’re saving without even thinking about it. 🚀💰 This approach makes growing your savings feel less like a chore and more like a victory lap.

💳 Learning the Art of Managing Debt

Imagine your debts as a sneaky monster that grows bigger with every buy now, pay later decision. It might seem overwhelming, right? The trick isn’t to fight this monster with a sword but to tame it, and that’s where smart strategies come into play. Just like how the ipad blink home monitor app keeps an eye on your home, understanding the nature of your debts, their interest rates, and how they fit into your budget helps you keep them under control. Think of it as organizing your financial closet – putting high-interest debts upfront to tackle them first, while not ignoring the minimum payments on others. This strategic approach not only prevents the debt monster from eating up your peace of mind but also paves a clear path towards financial freedom. And guess what? Seeing that debt shrink month by month feels just as rewarding as leveling up in your favorite game. 🎮💰✨

📈 Investing Wisely with Personalized Suggestions

Imagine stepping into the world of investing, where each step is tailored just for you. The Imac Credit Karma app acts like a wise friend who knows all about the finance world, guiding you on where to put your money so it can grow. Think of it as planting a seed in the right spot, where it gets enough sunlight and water to thrive. The app gives you hints and nudges on what investment options suit you best, whether it’s putting money into stocks, bonds, or maybe something else. It’s like having a map in a treasure hunt, where the X marks the spot for smart investing. Plus, it keeps an eye out for you, making sure you don’t fall into any traps or invest in something risky without knowing the full picture. Here’s a quick glimpse into how personalizing your investment strategy can make a significant difference:

| Standard Advice | Personalized Suggestions from App |

|---|---|

| Invest in a diverse portfolio. | Analyzes your financial situation and suggests specific investment types that match your profile. |

| Keep an emergency fund. | Calculates an ideal emergency fund size based on your monthly expenses and income stability, suggesting how much to set aside. |

| Watch out for high fees. | Identifies lower-fee investment options you might not know about, maximizing your returns. |

This approach ensures you’re not just throwing your money into the unknown but are making educated choices to help your finances flourish.

🛡️ Protecting Yourself from Financial Pitfalls

In the journey of managing our finances, walking towards a safer path is akin to holding a map in a vast forest; it guides and protects. Imagine stumbling upon a tool that not only shows you the direction but also warns you of potential pitfalls along the way. That’s where smart apps come into play, like a superhero shield in the digital age, safeguarding us from unseen financial dangers. It’s like playing a strategic game where every move counts toward our financial health. By harnessing personalized advice and alerts, we’re not just avoiding traps; we’re charting a course towards a secure future, ensuring our hard-earned money works for us, not against us. And for those who love diving into the world of finance with a bit of fun on the side, check out the ipad pokemon app, where navigating through financial wisdom becomes an adventure of its own. Remember, in the realm of personal finance, being forearmed with knowledge and the right tools is being forewarned against the pitfalls that lie ahead.