Unveiling the World of Ipad Budget Apps

Imagine stepping into a candy store, but instead of sweets, the shelves are stacked with all sorts of tools to help you manage your money – welcome to the world of iPad budget apps! 🌍💸 With just a few taps, you can have a personal financial assistant right in your hands, making it easier to keep track of your spending, savings, and everything in-between.

Now, let’s break it down. There are two main types of these apps: the ones that won’t cost you a penny and those that ask for a little investment in exchange for some fancy features. It’s like choosing between a standard bike and one with all the bells and whistles. 🚲💫 Both can get you to where you want to go, but the journey might look a bit different. By exploring these options, you can find the perfect fit for your financial journey and goals.

| App Type | Main Feature | Best For |

|---|---|---|

| Free Apps | Basic budgeting tools | Those new to budgeting |

| Paid Apps | Premium features like personalized advice | Those looking for detailed financial guidance |

Free Apps: a Wallet-friendly Helper?

When exploring the world of iPad budget apps, it’s like finding a hidden treasure chest 🏴☠️. Imagine stumbling across a collection of useful tools that promise to keep your finances in check without spending a single dime. It’s quite tempting, right? These free apps offer a range of features, from tracking your daily expenses to giving you gentle reminders about bills that are due soon. They’re like having a financial buddy by your side, helping you to save money while staying on top of your budgeting game.

However, it’s important to remember that not all that glitters is gold. While free apps can be a great starting point, especially if you’re new to budgeting, they may come with limitations. Sometimes you might find yourself wishing for more detailed reports or advanced features to really dig deep into your spending habits. But for anyone looking to dip their toes into the world of budgeting without upfront costs, free apps can shine a light on your financial path, guiding you towards smarter spending and saving habits 🌟.

Paid Apps: Unlocking Premium Budgeting Features

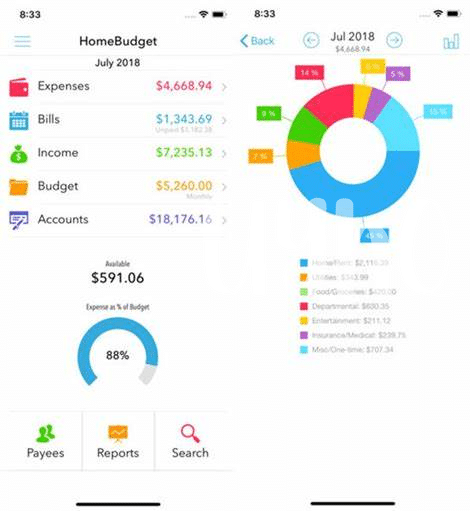

When you decide to spend a little on a budget app for your iPad, you’re opening a door to some pretty special features. Think of it like a secret garden where, beyond the gate, there are tools designed to handle more than just tracking expenses or setting up simple budgets. These apps often come with personalized advice, detailed reports, and sometimes even a one-on-one chat with a financial expert. 🌟 Imagine having a financial buddy in your pocket, ready to help you make smarter decisions with your money.

Opting for a paid app can be like giving your budgeting journey a turbo boost. You’re not just paying for the app; you’re investing in your financial well-being. With these apps, it’s easier to spot where you can save more and how you can reach your big money goals faster. Plus, they often offer more robust security features to keep your sensitive information safe. So, while the upfront cost might make you hesitate, the long-term benefits could be worth it. 💼🔒

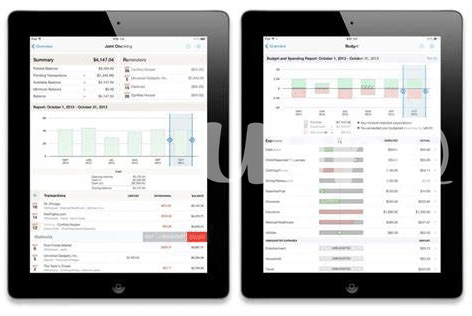

Navigating the User Experience: Free Vs Paid

When diving into the world of budgeting apps on your iPad, think of it as exploring a vast ocean 🌊. Free apps are like friendly dolphins 🐬, guiding you without asking for anything in return. They’re great for getting your feet wet, allowing you to track expenses and see where your money is going without dipping into your savings. On the flip side, paid apps are like seasoned captains 🚢, offering you a more polished voyage with advanced tools and personalized charts that can help steer your financial ship with precision. But what really sets them apart is the journey itself. With a paid app, you might find yourself enjoying smoother sailing with fewer ads interrupting your journey and exclusive features that make budgeting less of a chore and more of a breeze. This doesn’t mean free apps aren’t capable; they just offer a different kind of voyage, one that might require a bit more navigation on your part. While considering which route to take, remember, the goal is to find an app that not only suits your budgeting needs but also makes the journey towards financial health engaging. For more tools that can enhance your iPad experience, check out ios open table.

The Impact on Your Financial Goals

When you start planning how to manage your money, the tools you choose can make a big difference. Imagine you’re on a road trip. Free budgeting apps are like a simple map—they can guide you, but the details might not be as clear. On the other hand, paid apps are like having a fully-equipped GPS. They offer more features, like real-time updates and personalized routes, which can help you avoid financial potholes and reach your goals faster. 🚗💨

Think about what you want to achieve. Do you want to save for a dream vacation, or perhaps you’re aiming for a big purchase like a house? The type of app you use could influence your journey. While free apps are great for getting started and can certainly help you navigate, they might not provide the depth of analysis and customization that paid options do. Paid apps often come with tools that make planning easier and more effective, offering a clearer path to your financial goals. Remember, the right tools can take you from dreaming about your goals to actually reaching them. 🏡✈️

Safety and Security: Is Your Data Protected?

When diving into the digital world to manage our finances, protection for our personal data becomes as crucial as the budget itself. Think of your financial information as a treasure chest. 🏴☠️ Just like pirates, hackers are always on the lookout for valuable loot, making it essential to choose apps that are fortified against these modern-day corsairs. Free apps might be appealing for your wallet, but they often rely on ads for revenue. These ads not only clutter your experience but can sometimes be gateways for phishing attacks or malware. On the other hand, paid apps often invest more in robust security measures since they have the resources from your subscriptions.

Navigating through these choices, the primary question is whether our digital vaults are safe from prying eyes. 🔐 For a bit of thrill outside of budgeting, check out imac ukg pro best app for some hair-raising iOS scary games. While indulging in these digital adventures, remember that the same principles apply – safety first. Paid apps usually offer encrypted data protection, ensuring that your financial secrets remain just that – secret. Ultimately, whether free or paid, scrutinizing the app’s security promises and user reviews can illuminate the path to a shielded and stress-free budgeting experience.