The Basic Differences: Free Vs. Paid Apps

Imagine walking into a store where some goodies are tagged with a price, while others are up for grabs, no charge. That’s a bit like choosing between free and paid iPad budget apps. 🆓💰 With free ones, you dip your toes in the budgeting pool without opening your wallet. They’re great for getting started, offering basic tools to track where your money’s going. But, like a candy sample, they might leave you craving more. Paid apps, on the other hand, open up a treasure chest of advanced features. Think of these like a VIP pass – you pay an entrance fee, but once you’re in, the level of detail, customization, and extra services can really help you fine-tune your financial journey. So, it’s all about whether you’re okay with the basics or if you’re ready to take your budgeting to the next level. 🔄

| App Type | Cost | Features |

|---|---|---|

| Free | $0 | Basic budgeting tools, simple tracking |

| Paid | Varies | Advanced features, customization, more detailed tracking |

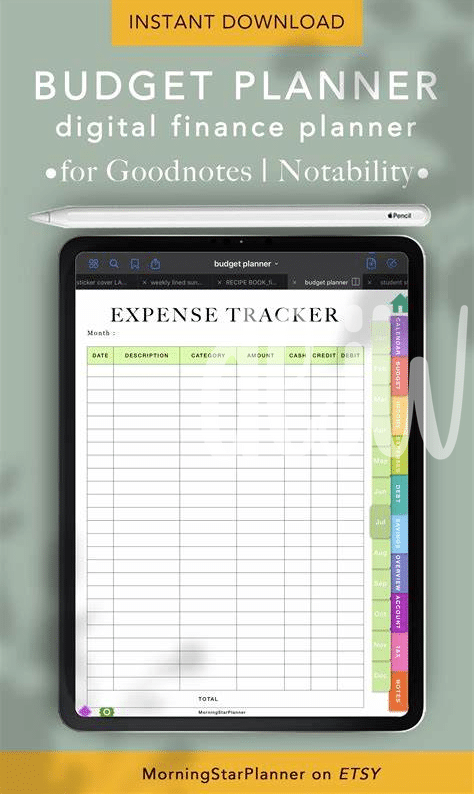

Exploring Features: What Do You Get for Free?

Diving into the world of iPad budget apps can feel like exploring a treasure map—each app holds its own set of jewels 🌟. The free versions are like the key to a hidden chest; they offer a peek into organizing your finances without spending a penny. Picture tracking your expenses, creating simple budgets, and sometimes, getting cheerful reminders not to overspend—all without opening your wallet. While they may not include every bell and whistle, these free apps are a great starting point for anyone looking to get their feet wet in the sea of personal finance management. Plus, you never know when you’ll stumble upon features that feel like uncovering hidden treasure. And for those who crave a bit more from their tech tools, peering into the realm of paid apps might reveal untold riches. If you’re curious about diving deeper into the app world, check out some spooky thrills at https://iosbestapps.com/mobile-nightmares-ios-horror-games-that-guarantee-sleepless-nights, where the line between fun and fear is thrillingly blurred.

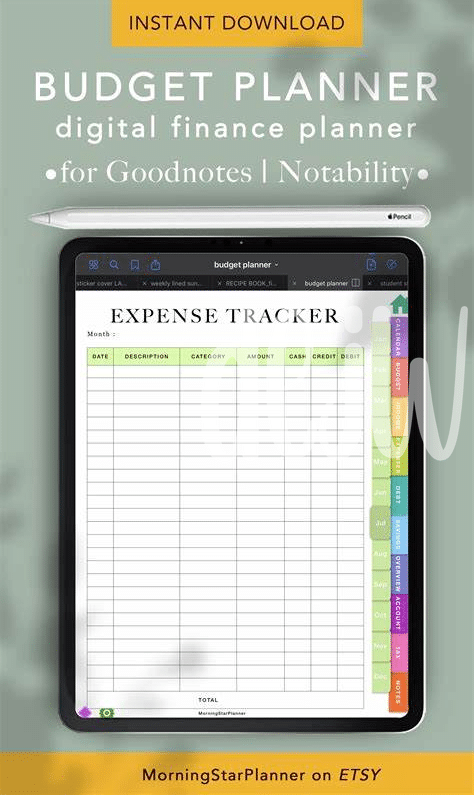

The Price of Premium: What Paid Apps Offer

When you decide to spend a little on a budgeting app for your iPad, you’re opening the door to some pretty cool features 🚀. Paid apps often give you more detailed ways to watch your spending, like offering personalized tips to save money. Think of it as having a mini-financial advisor right in your pocket!

But that’s not all. With a premium app, you also usually get a cleaner look and fewer ads popping up to distract you. This makes the whole experience smoother and more enjoyable. Plus, some paid apps even come with perks like connecting directly to your bank accounts to automatically update your budget 📊. So, while free apps are great, spending a bit could make managing your money easier and more efficient.

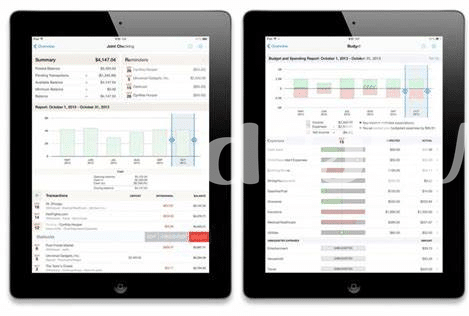

User Experience: Navigating Free Vs. Paid Interfaces

When navigating through iPad budget apps, you’ll notice a big difference in how free and paid ones feel and work. Free apps might get you started with basic buttons and straightforward menus, but sometimes they can have ads that pop up just as you’re getting into your budgeting groove 📊. On the other hand, paid apps often provide a smoother journey. Imagine sliding through your financial summaries like butter, with neat sections for every detail, minus the interruptions. It’s a bit like choosing between a busy street and a clear path; both get you to your destination, but one is definitely more pleasant. For creative tools that enhance your iPad experience, ios open table offers insights worth exploring.

The real joy, though, comes when you delve deeper. Paid apps might unlock special features – think of custom categories that fit your spending habits like a glove or insights that light up like a Christmas tree, showing you exactly where your money goes 🌟. Free versions provide a taste, but it’s the premium ones that let you feast. You’re not just managing numbers; you’re curating your financial landscape with tools designed to make everything clearer and your decisions smarter. This is where you measure not just the cost, but the value added to your life over time. Whether free or paid, your choice in a budget app can transform how you view and manage your money.

Long-term Value: Costs Vs. Benefits over Time

When considering budget apps for your iPad, it’s smart to look ahead. Think about not just what you’re paying today, but also what benefits you’ll reap over time 🕒. Free apps might seem like the no-brainer choice because, hey, they’re free! But sometimes, they can be a bit light on features, or you might encounter ads that can get in the way of your budgeting. On the flip side, shelling out a few bucks for a paid app can initially pinch your wallet, but the smooth, ad-free experience and richer features might make managing your money easier and more effective in the long run.

Here’s a simple way to see how costs and benefits stack up over time:

| Time Frame | Free Apps | Paid Apps |

|---|---|---|

| Initial Cost | $0 | Varies (e.g., $4.99) |

| 6 Months | Still $0, but potentially less effective | Cost remains the same, value increases with use |

| 1 Year+ | Possible need to switch apps | Consistent performance, higher satisfaction |

Choosing the right path depends on your personal needs and how dedicated you are to keeping your finances in check. Remember, a wonderfully designed app that saves you time and helps you make smarter choices might be worth more than the price tag suggests 🌟.

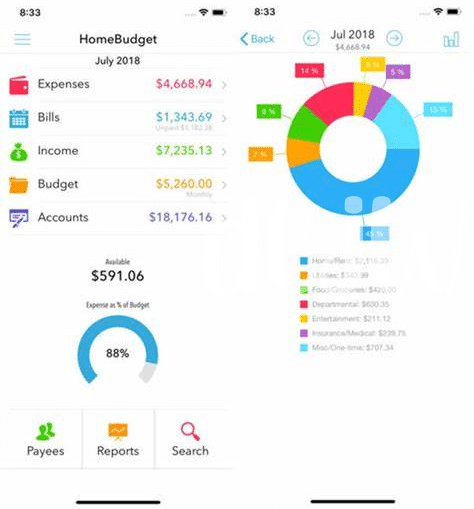

Making the Choice: Which App Fits Your Needs?

Deciding on the perfect iPad budget app might feel like choosing your favorite flavor at a vast ice cream shop 🍦. There are so many delicious options, but only one or two will truly satisfy your taste buds. For some, the joy comes from the free scoops, offering just enough sweetness to track your spending without dipping into your savings. Others might crave the deluxe version, with toppings and flavors (features) you never knew you needed, making it worth every penny. 🌟 It’s all about weighing what you get against what you’re willing to spend or save. Think of your financial goals, the complexity of your budget, and how much guidance you seek. If simplicity and cost-saving are key, free apps might be your go-to. But, for those craving depth, customization, and hands-on support, investing in a paid app can elevate your budgeting to gourmet levels. As you mull over your options, don’t forget to check out some bone-chilling excitement with imac ukg pro best app for those who love to mix financial wisdom with a touch of adrenaline from iOS scary games. Your choice should align with your financial landscape, ensuring a smoother journey towards your fiscal goals.✨