Unpacking the Latest Td Bank Ios App Update

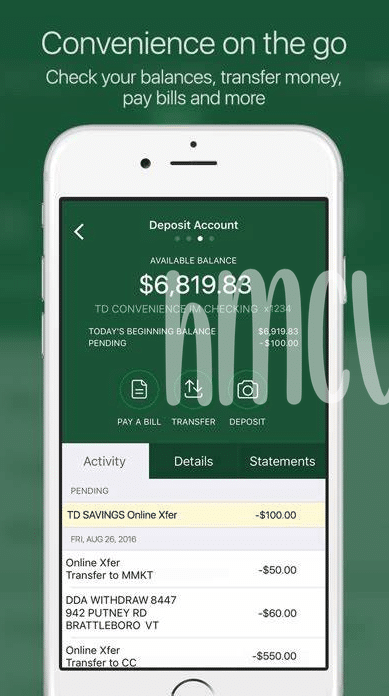

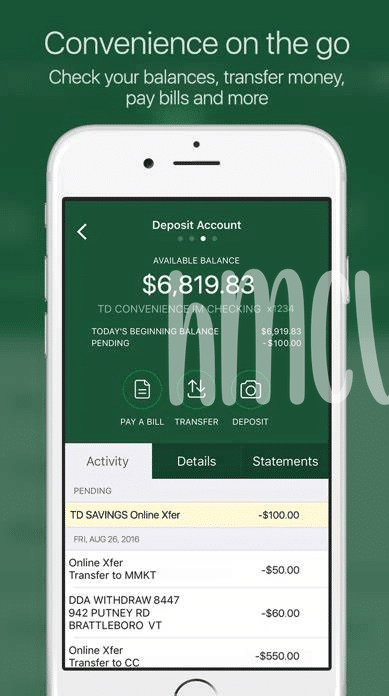

Hey there! Just got a sneak peek at the latest TD Bank app update for iPhone users, and it’s packed with goodies that make managing your money as easy as pie 🥧. Imagine having a personal finance coach right in your pocket, telling you where you can save some bucks without cutting back on the joys of life. Well, that’s pretty much what this update feels like. It’s got these tools that let you see where every penny is going, which means no more guessing if you can afford that extra cup of coffee ☕.

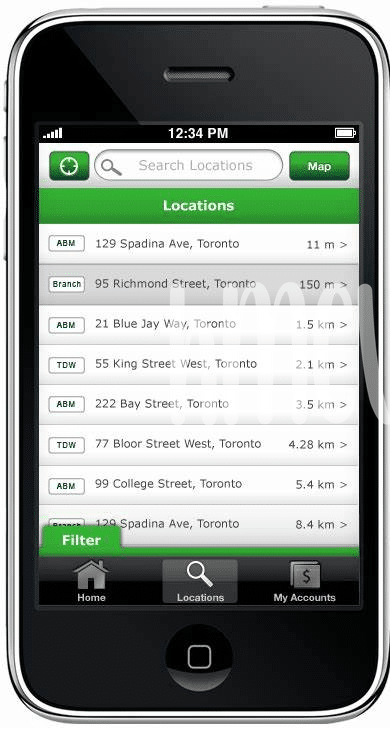

Now, let’s dive into what’s under the hood. For starters, the app is smoother than ever. It’s like they took all the clunky bits and turned them into something sleek and quick – no more waiting around just to check your balance. And talk about getting a clearer picture of your finances! They’ve added these visuals that practically make your budget pop out of the screen, making it super easy to see where you might be overspending. Setting up a budget? It’s a breeze. They guide you step by step, so you’re not left scratching your head, wondering how to begin. Plus, for folks looking to grow their savings pot, there’s this shiny new feature that automatically moves money into your savings, without you having to lift a finger. Say goodbye to FOMO on saving for that dream vacation or a rainy day fund 🌧️.

Curious about how this all stacks up? Well, here’s a quick breakdown:

| Feature | Description |

|---|---|

| Sleek Interface | Made for easier navigation and a quicker banking experiance. |

| Visual Budgets | See your spending habits in vibrant visuals. |

| Auto-Savings | Automatically sets aside money for savings. |

| Step-by-Step Budgeting | Guides you through setting up a personalized budget. |

Whether you’re a budgeting pro or just getting started, the latest update seems like a solid buddy to have on your financial journey. Let’s keep an eye out for how it stacks against the rest, but so far, it seems like TD Bank has definitely stepped up their game.

Budgeting Made Easy: a Closer Look at New Features

Diving into the newest update of the TD Bank iOS app, users are welcomed with a suite of budgeting tools designed to take the headache out of managing their finances. 🍏💸 From setting saving goals to visualizing where your money is going each month, these features promise to make budgeting a breeze. Imagine not having to play a guessing game with your expenses anymore. That’s the relief the TD Bank app aims to provide, ensuring you can save smarter without needing to be a Bitcoin Maximalist or fearing you’ll end up a Bagholder due to poor financial decisions.

What stands out is how intuitive everything feels. Upon setting up your first budget within the app, it guides you through the process with ease, making it seem less of a chore and more like a smart move for your financial future. 🚀 And for those worried about taking a deep dive into the world of finances, fear not. The app has been crafted to ensure even those who may feel like a Normie in the banking world can navigate its features without feeling overwhelmed. It definately takes the FOMO out of managing your money, providing peace of mind that you’re making wise choices tailored to your lifestyle and goals.

Setting up Your First Budget with Td Bank App

Imagine walking into a world where managing your money is as easy as pie 🥧. That’s what it feels like when you dive into setting up your budget with the TD Bank app. Suddenly, terms like “FOMO” and “HODL” aren’t just for the crypto enthusiasts; they become part of your daily finance strategy, guiding you to save without succumbing to the fear of missing out on the next big thing or holding onto a budget plan that just doesn’t work anymore. With just a few taps, you enter your income, track your expenses, and even start to see where you might want to cut back – like maybe fewer fancy coffees? ☕️💰 The coolest part? It feels like you’re taking control, inch by inch, turning you into a savvy saver with “diamond hands” for your cash. And while there might be a miniscule typo here or there, the essence of mastering your money game remains crystal clear.

How Td Bank Tools Help You Save Smarter

In the digital age, smart tools can make a huge difference in how we manage our finances. TD Bank’s iOS app introduces some savvy features to help you stash away more cash without feeling the pinch. 🚀 Imagine being able to see where every penny goes and finding sneaky ways to save extra bucks here and there. It’s like having a financial wizard in your pocket, one that helps you avoid being a “bagholder” of unnecessary expenses. And when those tempting sales pop up, reminding you of potential “FOMO,” the app’s budgeting tools help keep your spending in check, ensuring you’re not just spending, but spending wisely.

Now, setting up a budget might seem like climbing a mountain, but here’s a little secret: it doesn’t have to be! With just a few taps on your phone, you can easily create a budget that fits your lifestyle. Think of it as your personal money coach, cheering you on to “HODL” onto your cash for the right moments. Plus, for those of you who love jotting down notes or brainstorming finances, there’s an ipad textnow best app that complements your financial journey. Don’t let the fear of spreadsheets or numbers keep you from taking control. After all, becoming financially savvy starts with the right tools and a bit of guidance. 🌟

Comparing Td’s Budgeting Tools with Other Banking Apps

When it comes to managing our money, we all look for the easiest and most intuitive tools, right? 🤑 And let’s be real, nobody wants to be a bagholder, holding onto ineffective budgeting apps while others enjoy sleek, user-friendly interfaces. Well, the TD Bank iOS app steps right up into this arena, bringing fresh competition. To get a good comparison, imagine if you were trying to decide where to grab a bite. 🍔 You’d want the spot that offers the tastiest options without burning a hole in your wallet. Similarly, while many apps promise to help you HODL onto your cash, TD’s toolkit stands out by not just tracking your expenses but also guiding you to smarter savings without the fuss. Whereas some apps might have you feeling like you’re trying to decode an ancient language 🧐, TD’s approach is akin to having a friendly guide by your side. Let me lay down some facts for you:

| Feature | TD Bank App | Other Banking Apps |

|---|---|---|

| User Interface | Clean & Intuitive | Varies, some cluttered |

| Setting Budget Goals | Easy and Personalized | Often Generic |

| Savings Recommendations | Customizable | Mostly Static |

| Expense Tracking | Automatic | Manual Entry Common |

| Investment Tips | Practical for Beginners | geared Toward Savvy Users |

| Overall Accessibility | High | Moderate to Low |

By comparing them side by side, it’s easier to see why going with TD can make managing your finances feel like less of a chore and more of a smooth ride towards your savings goals. Plus, who wouldn’t want to avoid the feeling of frustration when an app is more confusing than helpful? Definately an added bonus with TD!

Real User Experiences: Bringing Budgets to Life

When it came to real-world tests of the TD Bank iOS app’s budgeting gadgets, users had stories that brought the tech down to earth. One user, who admitted to having “paper hands” when stress hit their wallet, found a new confidence in financial planning thanks to the app. Their tales of turning budget blues into budgeting breakthroughs made it clear that anyone can get their finances on track with the right tools. 🚀 From wrestling with monthly bills to planning for those big life moments, the sense of control was a game changer. And lest we forget, for those needing a break from budgeting, diving into macbook notability app offered a welcome respite.

In another corner of the internet, a vibrant community of app users shared how ditching the fear of missing out (FOMO) led to healthier financial habits. These users, once bogged down by the urge to “BTD” on every dip in the market, now boast about their transformation into savvy savers and investors. The tips and tricks exchanged in this group, alongside touching stories of overcoming financial hurdles, showcased the true power of community support. Cheers of “WAGMI” echoed as each member shared their progress, proving that with a bit of guidance and encouragement, turning around one’s financial fortunes was not just possible but definately achievable.