The Birth of Sofi: Revolutionizing Banking Apps

In a world where tapping on a screen gets you a ride or dinner, banking has finally caught up, and SoFi is leading the charge 🚀. Picture this: a one-stop app that not only holds your money but also makes it grow, gives you tips, and even rewards you for smart decisions. SoFi, short for Social Finance, flipped the script on traditional banking. It didn’t just stop at safe money-keeping; it reinvented the wheel by creating an enviroment where your finances could thrive – think of it as having a financial wizard in your pocket. Despite the skeptics, who were as hesitant as ‘normies’ entering the crypto space, SoFi embraced the challenge. People started to notice. No longer were they just holding onto their digital ‘bags’ hoping not to get ‘rekt’; they were actively growing their wealth. It was a beacon for those fed up with the old-school banking maze, offering clarity, simplicity, and a bit of magic ✨.

| Feature | Benefit |

|---|---|

| Mobile-first design | Banking anytime, anywhere |

| Financial tracking and insights | Smarter money management |

| Rewards for users | Incentivizes smart financial habits |

| Investing on the go | Grow your wealth effortlessly |

SoFi didn’t just aim to coexist with traditional banks; it set out to rewrite the rules. From the cushy corner offices to the everyday user unwrapping the potential of their finances, the landscape of banking is definately looking different.

Sofi’s Unique Approach to Money Management

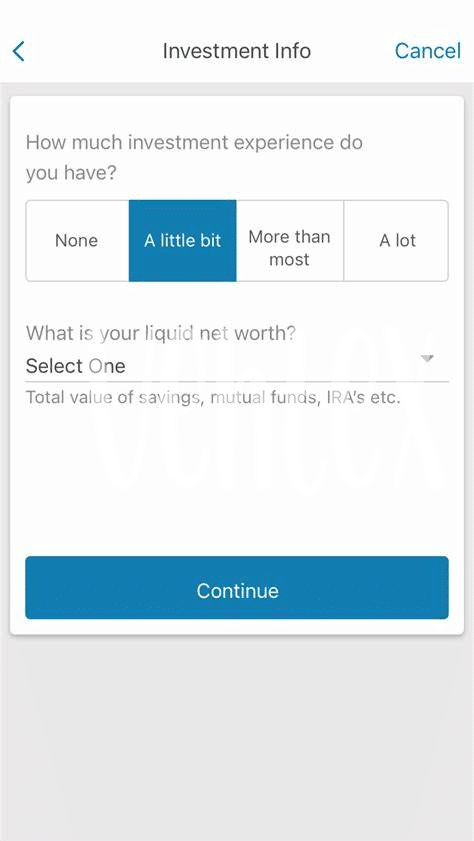

In the bustling world of mobile banking, Sofi stands out by making your money worries a lot chill. 📱💰 Think of it like having a financial guru in your pocket, guiding you to smash those savings goals without breaking a sweat. While some folks are out there trying to HODL despite the FOMO of skyrocketing cryptos, Sofi brings it back to basics with a fresh, friendly approach. You won’t find any complex jargon here – just straightforward tools that help you keep track of your cash, see where it’s going, and even grow it. And for those who’ve ever felt like a bagholder with their traditional bank, Sofi’s like a breath of fresh air, offering a way to manage your moolah without the usual headaches. It’s all about making your financial life as smooth as butter, proving that you don’t have to be a Wall Street whiz to keep your finances on lock.

How Sofi Makes Everyday Banking Simpler

Imagine waking up to a banking experience that feels like it’s from the future, where managing your money is as easy as sending a text message. This is what SoFi brings to the table. With its sleek interface, SoFi declutters the often-complicated world of banking, making it straightforward and user-friendly. No longer do you have to be a bitcoin maximalist or dive deep into cryptosis to get ahead in your finances. SoFi has streamlined the process, ensuring that whether you’re trying to save, invest, or just pay the bills, everything is at your fingertips, literally. It’s about saying goodbye to the days of being a bagholder of cumbersome banking processes and embracing the simplicity and efficiency of SoFi. And even if the market seems to be doing the moonwalk under your feet, SoFi helps you keep your chill, ensuring you always know where you stand financially without having to decode complicated lingo or navigate through endless hoops. With SoFi, it’s all about making your financial journey as smooth as possible, allowing you to focus more on living and less on worrying about your money.

The Impact of Sofi on Traditional Banking

In the ever-evolving world of fintech, Sofi is definitely shaking things up and making waves among traditional banks. With its user-friendly interface and innovative features, it’s no wonder that everyone from the casual saver to the hardcore investor is taking notice. Traditional banks, often seen as stuffy and out of touch, are now scrambling to catch up, lest they become irrelevant. This is a classic case of “FOMO” hitting the big institutions hard, as they realize that not jumping on the digital bandwagon could mean missing out on a huge chunk of the market.

Adding to the pressure is the fact that users are now demanding more transparency and ease of use in their banking experiences – something that Sofi has in spades. Banks are being forced to rethink their approach or risk becoming the financial world’s “bagholders,” stuck with outdated systems while the rest of the world moves forward. For anyone keeping an eye on the future of money management, checking out the imac strava app is a good glimpse into where things might be headed, marking a point where traditional banking and modern fintech solutions could either collide or coalesce.

Sofi’s Future: What’s Next for Mobile Banking?

Looking ahead, SoFi is poised to not just ride the waves of change in mobile banking but to make them. With an innovative mindset, SoFi could redefine “normie” experiences in finance, making high-tech tools approachable for everyday folks. Imagine tapping your phone to manage investments as easily as sending a text message, or getting AI-driven advice that feels like chatting with a smart friend. Traditional banks may need to catch up or collaborate to stay in the game, as SoFi blurs the lines between financial services and tech magic. 🚀💡📱 Expect SoFi to continue shaking things up, possibly introducing features that might make us say “LFG” to our financial goals. Will traditional banks watch from the sidelines or dive into the digital transformation? Only time will tell, but one thing’s for certain: banking is about to get a whole lot cooler.

| What to Watch | Why It Matters |

|---|---|

| Innovative Features | Making finance management as simple as texting. |

| AI-Driven Advice | Personalized help that feels like a conversation. |

| Collaboration with Traditional Banks | Potential for richer, more integrated services. |

User Experiences: the Real Game Changer

People are talking about how they feel like they’ve hit the moon 🌕 when they use Sofi for their banking needs. It’s all because Sofi listens to what people really want and then delivers it, making everyone feel like they’re part of a special club where they actually enjoy managing their money. Imagine that! Plus, with features designed around real-life needs, from saving to spending, it’s no wonder folks are saying bye-bye to their old banks and hello to something way cooler. A bit like finding that secret level in your favorite video game 🎮 that makes everything more fun.

And let’s not forget the stories floating around about folks who were once bagholders with other banks but are now proudly sharing their Sofi experiences at dinner parties. It’s not just about not having to worry when things go a bit sideways in the economy; it’s about feeling like you’re ahead of the curve. For anyone still on the fence, there’s plenty of first-hand stories to prove that making the switch to Sofi is a no-brainer. Want to see for yourself why everyone’s talking about Sofi? Check out the ios duo for a glimpse into the future of banking, minus the hassle and with all the perks. Trust me, your wallet will thank you. And yep, there may be a few bumps along the road (hello, occasional typo like “experiance”), but they’re nothing compared to the ride traditional banks take you on.