Setting up Touch Id for Quick Secure Access

Imagine walking into a coffee shop, ready to kickstart your day. You pull out your iPad, eager to check on your finances before diving into work. But hey, wouldn’t it be awesome if you could just tap and go, ensuring your details stay locked tight? 💡🔐 That’s where biometrics step in, transforming your morning routine into a high-tech, secure experience. Think of it as having diamond hands for your financial security, not letting anything shake your peace of mind. And just in case you’re worried about setting it up, fear not! It’s as easy as pie.

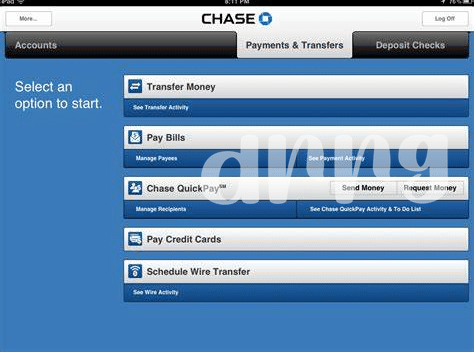

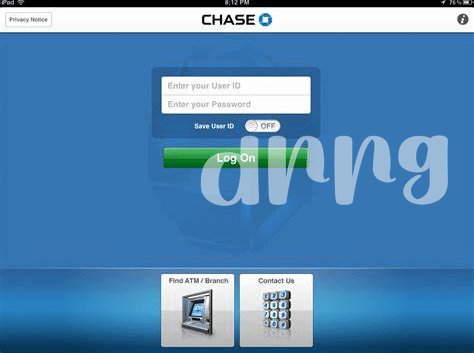

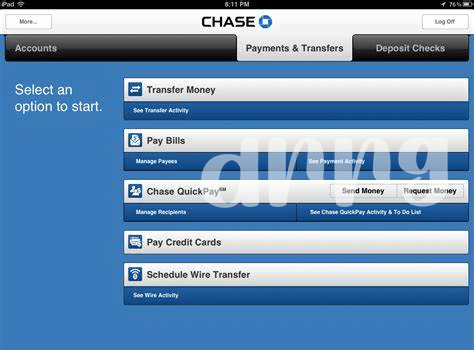

| 👆 Step 1: | Open your Chase app. |

| 🔍 Step 2: | Find the ‘Settings’ menu. |

| ✨ Step 3: | Select ‘Touch ID’ and switch it on. |

| 🔒 Step 4: | Follow the instructions to enroll your fingerprint. |

Once done, you’re all set to access your account quicker than you can say, “When Lambo?” Plus, you’ll dodge the normal hiccups like typo errors in your password or the frustration of forgetting it—as if those mistakes never happned. Enjoy that extra layer of security, giving you one less thing to worry about in your busy day. 🚀

Regularly Updating Your App for Latest Security Patches

Just like updating your phone keeps it running smoothly, giving your banking app a quick refresh can make it a lot safer. Think of it as teaching your app new tricks to keep the bad guys out. It’s kinda like when superheroes get cool upgrades to battle villains better. And, who doesn’t want their financial sidekick to be in top form? Plus, staying on top of those updates is a piece of cake; you just tap a button and poof, your app is not just smarter, but also tougher for any sneaky hackers. Imagine it as a digital superhero cape that keeps getting better. So, don’t snooze on those update notifications – they’re pretty much your app going “LFG” on security threats. Remember, every update is a step forward in keeping your money as safe as a diamond hands investor during a market dip. And, if you’re out and about, dreaming of leveling up your tech game, don’t miss out on discovering new treasures. Dive into a world of digital delights with this cool find – https://iosbestapps.com/revamping-your-digital-wardrobe-imacs-best-fashion-apps. Whether you’re banking or gaming, staying updated is the key!

Enabling Two-factor Authentication for Extra Safety

In today’s digital age, staying safe online is crucial, especially when it comes to your finances. Think of two-factor authentication (2FA) as a double lock for your digital front door, keeping your financial house secure. 🛡️ Just like you wouldn’t hand over your house keys to a stranger, you shouldn’t rely on a single password for protecting your banking app. Enabling 2FA is like having both a key and a security code – unless someone has both, they can’t get in. This not only keeps the bad guys out but also gives you peace of mind.

However, even with such robust security measures, always keep an eye out for phishing scams and remember, the bank will never ask for your password or security code via email. 🚫📧 And, because we’re all human and mistakes can happen, make sure to regularly update your contact information within the app. This ensures that you recieve timely alerts and notifications directly from your bank, helping you react quickly if something looks fishy. So, go ahead and give yourself that extra layer of protection; it’s definately worth the few minutes it takes to set up!

Recognizing and Avoiding Phishing Scams in Emails

In today’s digital age, it’s crucial to stay sharp about the sneaky tricks hackers use to snatch your private info. Imagine getting an email that looks legit, but uh-oh, it smells fishy 🐟. That’s phishing, folks, and it’s no joke. Phishing emails are dressed to impress, pretending to be from your bank or a trusted source, tricking you into giving away your secret codes. Now, you’re thinking, “How do I dodge this bullet?” First off, DYOR – don’t just click on links willy-nilly. If an email asks for your details or to click on a link, pump the brakes 🛑. Do a tiny detective work — look at the sender’s email address, any weird spelling errors (like “recieve” instead of “receive”), or if it just screams FOMO but feels off. Hackers are getting smarter, but you’ve got this. And hey, while you’re keeping your transactions smooth and secure, why not unwind with some imac offline games app? Keeping your digital life secure doesn’t mean you can’t have fun, right? Remember, in this game of digital cat and mouse, staying one step ahead is key. So, let’s keep those phishing scams at bay and your banking details safe and sound.

Securely Connecting to Wi-fi Networks While Banking

When it’s time to check on your stash or make a move, connecting to Wi-Fi seems like the easy route, especially when you’re not at home. But wait up! Not all Wi-Fi is safe, 🛡️ especially public hotspots that feel like a normie’s playground but are actually a paradise for those looking to snag valuable information. Imagine doing a quick check on your assets, and boom, you’re on a risky network. That’s like opening the door and inviting a whale into your living room to take whatever they want.

To dodge such troubles, always look for secure connections, even if it means using your data plan or carrying around a trusted portable Wi-Fi device. Think about it like protecting your bag – you wouldn’t leave it open while you scroll through your phone, right? 📱 Secondly, remember the golden rule: if a Wi-Fi asks for too much personal info, swipe left. You’re better off waiting untill you’re on a network that doesn’t need your first pet’s name to connect. It’s a small habit that can save you from becoming a bagholder because of a simple mistake.

| Do | Don’t |

|---|---|

| Use secure, known Wi-Fi networks | Connect to open, public Wi-Fi without verification |

| Consider using a VPN for added security | Ignore warnings or prompts about network security |

| Regularly monitor your banking transactions for peace of mind | Share personal information to access Wi-Fi networks |

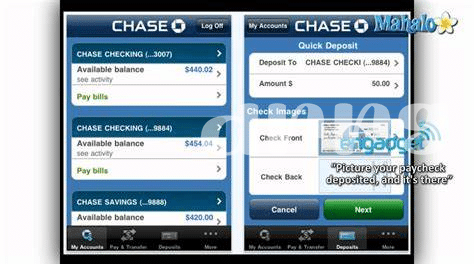

Monitoring Transactions Regularly for Unusual Activity

Keeping an eye on your transactions might just save you from becoming a bagholder. You know, when you suddenly notice your money taking a nosedive, and you’re left holding the bag, hoping your funds will bounce back. It’s not just about watching numbers go up and down; it’s like being a detective in your financial world. If something looks off, like a payment you don’t remember making, it could be a sign that someone else is taking a joyride with your account. So, staying vigilant helps you catch these anomalies before they turn into a financial headache.

Now, imagine if you had diamond hands but with your attention to your transaction history. You’re unshakeable, always on top of things, even when the market (or in this case, your account balance) gets turbulent. It’s not just about checking in once in a blue moon; it’s about making this habit part of your routine. And hey, if you’re looking to take a break from being the guardian of your galactic finance empire, why not check out the latest in entertainment with ios apple store? It might just be the perfect way to relax after ensuring your financial universe is safe and sound. Remember, keeping a close eye on your financial movements is essential – it’s easier to spot a scam before it’s too late, and that’s something even cryptojacking fearers should keep in mind.